NFT and Music lovers

- 2023.08.15

- blog

- Art, entertainment, music, NFT

- 1. Intellectual Property Rights Discussion

- 2. Would you be pleased if someone used [your work] without permission?

- 3. Misunderstanding and Prejudice

- 4. Entry Barrier

- 5. A Bridge Between Nations

- 6. The Biggest Question About NFTs

- 7. What has changed?

- 8. Blockchain

- 9. The concept of “ownership”

- 10. A $100 bill

- 11. The most important point

- 12. Merry Christmas, Mr. Lawrence

- 13. The Power of Capital Economy

- 14. The Digital Network Era

- 15. Wrap-up

Intellectual Property Rights Discussion

Even if in a socially disadvantaged position, those who utilize music must generally pay copyright fees. This is because intellectual property rights must be upheld. Otherwise, musical culture would decline.

Fundamentally, people in the position of safeguarding musical culture assert while collecting and regulating that, “We are protecting creators and their works.”

Wouldn’t you agree that there are flaws in the system? Do you think that because it has been in place throughout history, there is no sense of uneasiness? Personally, I’ve always felt apprehensive about the system.

Would you be pleased if someone used [your work] without permission?

The current intellectual property management system operates on the principle of “regardless of being a vulnerable individual or anyone else, if you use music, you must pay something.”

On the other hand, there is a method called NFT (Non-Fungible Token). Simply put, it’s an approach that says, “The powerful protect the works and creators, so everyone else is free to enjoy the music”.

NFT, despite being relatively new, actually shares a striking resemblance to the mechanics of art, such as with paintings. Take the example of the Mona Lisa. It’s used without permission on various items like postcards, calendars, and jigsaw puzzles all around the world. However, the authentic piece resides in the Louvre Museum in Paris, and that’s what the world recognizes.

If this were the exploitative copyright management system mentioned earlier, the owner, in this case the French government, would come forward and say, “You used the Mona Lisa on postcards, didn’t you? Well, you have to pay $$$ for it.”

However, the Mona Lisa is being used without permission all over the world, and thanks to that, its value has risen. In recent years, its estimated market value is said to be around 800 million dollars.

It’s quite clear which mechanism nurtures artistic culture. The adoption of NFTs has the potential to increase the number of music lovers is as evident.

While there are certainly cases where supporters make purchases, currently NFTs are predominantly treated as assets by global investors. By investing in NFT works (intellectual properties like digital-based paintings, music, videos, etc.), investors help safeguard both creators and their works financially.

Unlike the traditional exploitative copyright management system, with NFTs, the more a work is naturally handled by many individuals (within the legal scope of personal use), the more its asset value increases following the principle of the aforementioned Mona Lisa. This makes investors, music lovers, the weaker parties, and creators with their works happy. In essence, as long as improper use is avoided, no one becomes unhappy.

Misunderstanding and Prejudice

NFTs have gained a reputation for quick riches and fraud in some countries and regions. Certainly, there are aspects that support this perception, so individuals should exercise caution, particularly regarding the latter.

However, if someone says, “NFTs are scams, so I won’t get involved,” that’s a rather embarrassing stance.

- I won’t use email because I receive spam messages.

- I won’t have a bank account with financial institutions because I might fall victim to phishing scams.

- I won’t go outside because I might trip and die.

- I won’t breathe because I’m afraid of germs.

It’s akin to saying.

NFTs are the same in that regard. If one doesn’t manage their personal account properly or becomes blinded by the desire for quick riches, they could naturally fall prey to scams.

Therefore, does that mean NFTs are inherently bad?

Because media sometimes portrays a few success stories as if they represent the entirety of NFTs, there’s a sense that they are considered suspicious. However, it’s easy to understand that NFTs weren’t originally designed to be perceived in that way if one gains a proper understanding.

Entry Barrier

Overseas, mechanisms have been functioning for years as safeguards for talent and works. If NFTs had existed during Van Gogh’s time, his life would likely have taken a significantly different path.

It’s not limited to the realm of art.

NFT’s core strength lies in ‘proving uniqueness,’ which is why it’s starting to be employed in ticket systems, for instance.

In the not-so-distant future, it’s likely that NFTs will become an integral part of essential societal infrastructure for humanity, akin to electronic money becoming a routine aspect of daily life in recent years.

Of course, NFTs still have a high entry barrier for many people. The reasons include…

- Foreign exchange risk

- Cryptocurrency-based transactions

- Blockchain‘s SDGs issues (Concerns about CO2 emissions as a result of blockchain operations; however, it’s worth noting that social media platforms in general emit significant amounts of CO2 every second, making this a challenge for the entire digital network)

- Complexity for individuals less familiar with the internet (While user-friendly platforms are gradually increasing, there’s hope for swift solutions)

- Gas fee (Unlike platforms like Twitter, Facebook, and YouTube, NFTs aren’t controlled by specific corporations with the capacity to absorb substantial energy costs. Thus, the gas fees (equivalent to energy costs) incurred during transactions are shouldered by users and are essentially unavoidable.)

Indeed, as the user base and participating companies grow, NFTs should undergo improvements. This pattern has been observed with previous new systems as well.

A Bridge Between Nations

Amid the COVID-19 pandemic, there is a remarkably kind-hearted Mexican individual who was wrongly arrested and imprisoned in a Tokyo detention center for two years.

In Japan, the conviction rate for criminal cases is 96.3%, while the acquittal rate is only 0.2%. This means that statistically, once someone is indicted, obtaining an acquittal verdict is nearly impossible.

Through my unwavering dedication and the relentless efforts of the defense lawyers, after two years, his wrongful conviction was overturned. Embracing the miracle of his acquittal and state compensation, the traumatized man departed for his homeland.

After enduring two years of unjust imprisonment in a foreign land where language was a barrier, I ventured to propose the potential of NFTs to him, meddling a bit. Recently, it seems he has finally started exploring it. If you’re willing, visiting his website and perhaps purchasing something you like could make him realize that “there are kind people in the world,” and I believe he would be delighted.

I dream that this new system called NFT will spread across the world and become a means to rescue more vulnerable individuals.

The Biggest Question About NFTs

With the proliferation of subscriptions, music is rapidly shifting from an era of actively listening to an era of passive streaming. Humanity is currently at the most significant turning point in the history of music. Do you sense a crisis of cultural decline?

I believe that NFTs have the potential to become a game-changer that can save this crisis.

However, why would people pay hundreds of dollars for intangible digital data that can be easily replicated and shared by anyone?

Most people who lack knowledge about NFTs inevitably harbor this question.

To fully comprehend the concepts bellow, it’s necessary to dismantle old notions and embrace new perspectives. Given the multitude of essential elements that can’t be glossed over, I would be glad if you could approach this not as a lengthy blog, but rather as a concise book.

What has changed?

I assume many readers have a credit card.

A quick question: When you make a purchase with that card, does the weight of the card change?

In reality, the condition of the card generally doesn’t change.

So, what has changed?

“The value of your card is currently X$, and with this transaction, its value has changed to Y$.” This is because all payment terminals across the world simultaneously acknowledged (or got in a state to acknowledge) during a credit card transaction. This is the change in credit card transactions.

Now, let’s talk about trading in gold assets.

When the economy leans towards inflation, investors rush to buy gold. Imagine you bought 10,000$ worth of gold through an online brokerage.

No matter how many days or years pass, that gleaming gold bar won’t be delivered to your home.

Investors are in the same boat—pouring billions into gold, yet not possessing a single gram physically.

In the moment you buy intangible gold, what exactly changes?

The answer is, “All the terminals involved in securities trading worldwide simultaneously acknowledge that you have indeed purchased gold worth $$$ at the current market value and that you currently own it.

Now, finally, let’s consider how it works with NFTs.

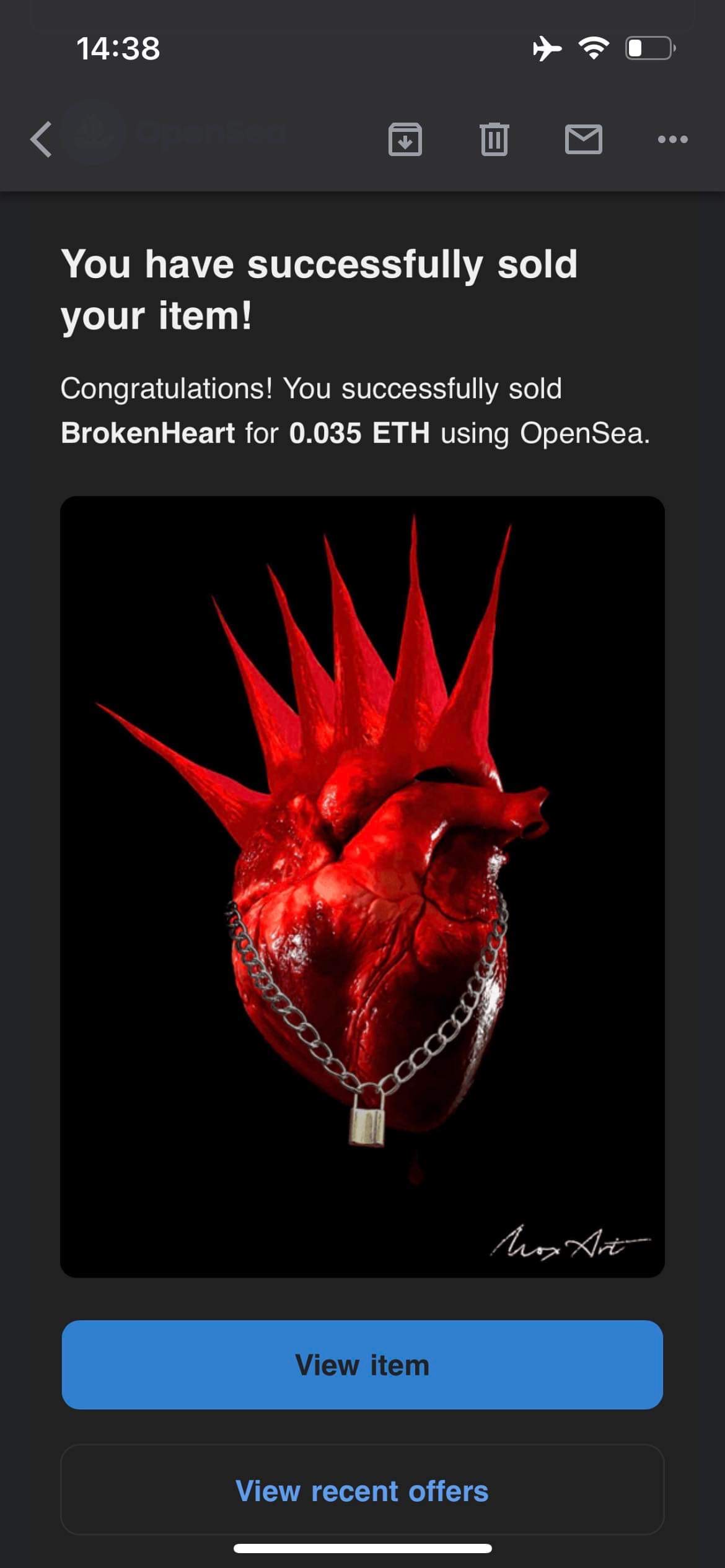

Let’s say you’ve purchased a digital artwork from the Traumatized Man collection that you really like, for 60$.

Your smartphone doesn’t become heavier due to the purchase, and the digital artwork isn’t physically delivered to you.

On the contrary, it’s replicated by many strangers, spread across social media without your control, and even people like me may paste it into a blog without permission.

You might think, “I paid 60$ for that! I’m the one facing a tragedy!

So, when you purchase NFT art, what changes?

The correct answer is, “You have indeed purchased this digital artwork for 60$, and you now own the truly unique original, as acknowledged by all internet-connected devices worldwide.”

Whether it’s a credit card, gold assets, or NFTs, the change occurs on the side of the “devices worldwide,” not on your side.

Blockchain

Furthermore, in the case of NFTs, during the process of tokenization, the most crucial mark (i.e., blockchain) is inscribed to incontrovertibly prove that it is the one and only original in the world.

Even if the artwork is duplicated, spread extensively across the world, and nobody can individually identify those copies, the indelible mark that signifies the one and only original will perpetually and automatically prove its uniqueness to internet-connected devices globally.

Therefore, no matter how much it’s replicated, disseminated, or even used by someone unknown (within the legal scope of personal use), the owner is never at a disadvantage.

If you try to perceive NFTs with the same sense of ownership as conventionally understood, you’ll never comprehend them.

Unless you shatter that old notion, even if you read through a hundred books on NFTs, your questions won’t be resolved.

The concept of “ownership”

Owning” an NFT isn’t about merely storing an image on your smartphone, looking at it with a smile, and showing it off to others (of course, it’s yours to do as you please). Rather, it’s more accurate to say that you “own the concept of owning it.

The value of the Mona Lisa isn’t influenced by its physical “condition” or “quality,” but rather by the “situation” that the authentic piece resides in the Louvre Museum, owned by the French government, and the entire world recognizes that any other Mona Lisa found elsewhere is a forgery.

Hence, the more people freely use copies, the more it becomes known that “everyone knows about the Mona Lisa,” ultimately raising the value of the genuine piece. In other words, the value of a painting is determined solely by how it’s perceived worldwide.

Even if identical replicas that even the world’s greatest appraiser couldn’t distinguish from the original emerge, they hold no value other than being the real thing.

If you can grasp this much, then the time when you can confidently state, “NFT? I have a good understanding,” is quite close.

A $100 bill

… In fact, everyday bills and coins operate on precisely the same principle.

Because everyone acknowledges that “a $100 bill holds value,” it does indeed have value.

Furthermore, whether a $100 bill is tattered or brand new, its value remains entirely unchanged.

You could try gifting a $100 bill to an extraterrestrial being.

The response might be something like, “Thank you, it’s a neat piece of paper. I’ll accept it, just in case.”

Even if you were to lay out 10,000 $100 bills, filling a silver aluminum case to the brim, and briefly show it, the extraterrestrial being might exclaim, “That box looks incredibly nice! Can I have that?” Then, they might hand back the contents and start dancing with the empty aluminum case.

From the perspective of a device (an extraterrestrial being) that doesn’t recognize the value of “a $100 bill,” it’s simply a piece of pretty paper.

The most important point

Credit cards are not just pieces of plastic precisely because they are recognized by all dedicated terminals.

Gold can be owned as an asset precisely because it is recognized by securities terminals around the world.

Likewise, NFTs derive their value from being recognized by internet-connected devices worldwide. Even if your smartphone gets water-damaged and the image data is irrecoverable, the “situation” that you’re the person owning the one and only genuine item doesn’t change.

This is an extremely important point, so let me reiterate it once more.

If you try to perceive NFTs with the same sense of ownership as conventionally understood, you’ll never comprehend them.

Unless you shatter that old notion, even if you read through a hundred books on NFTs, your questions won’t be resolved.

Merry Christmas, Mr. Lawrence

One of Japan’s celebrated talents, the late Ryuichi Sakamoto, NFT-ized each individual note of his iconic work “Merry Christmas, Mr. Lawrence” in his later years. The news of him releasing a total of 595 music notes separately as NFTs created a buzz worldwide. However, most people haven’t quite grasped what actually happened.

I’ll provide a detailed explanation, so please stay with me until the end without giving up.

Do you remember the phrase I mentioned twice in this blog: “within the scope of personal use permitted by law“?

In NFT transactions, what the buyers receive is “ownership,” not “copyright.”

Commercial use of a copyrighted work (in this case, the music: “Merry Christmas, Mr. Lawrence”) is exclusively permitted to the copyright holder (in this case, Ryuichi Sakamoto), and anyone else, including NFT owners, are prohibited by law from engaging in activities that go beyond “personal use” (such as making profits from selling copies of the work).

If Ryuichi Sakamoto were still alive, he would still have the freedom to perform the song and continue selling the music just like before. In other words, NFTs generally don’t interfere with traditional “artist activities.”

Can you remember one more thing mentioned in the earlier part of this blog?

The current intellectual property management system operates on the principle of ‘regardless of being a vulnerable individual or anyone else, if you use music, you must pay something.

In response to this, there is a method called NFT (Non-Fungible Token). Simply put, it’s an approach that says, “The powerful protect the works and creators, so everyone else is free to enjoy the music.”

Those with keen insight might already have guessed.

The late Ryuichi Sakamoto’s intention behind his NFT actions was not to protect his own wallet, but rather to safeguard “future talents and the culture of music” for generations to come.

The Power of Capital Economy

Are you ready to finish with the learning about the “NFT Music Notes.” ?

Let’s move on to the last part of it.

Each individual music note is stamped with the NFT’s “signature” of being the “unique original” and the moment all internet devices worldwide simultaneously recognize it, it gains a certain “value” akin to credit cards, gold, or a $100 bill.

In December 2021, the journey of the 595 NFT music notes from “Merry Christmas, Mr. Lawrence” began.

NFTs are designed to make detailed information such as “who purchased it from whom, at what price, who owns it currently, and at what price it is currently for sale” always visible to users worldwide, including complete transaction histories.

Similar to investors analyzing corporate financial statements and performance trends to make decisions about individual stocks, the valuation of NFTs is also constantly under the scrutiny of users worldwide.

In a capitalist society, if there is a certain number of individuals who believe “this value is going to rise further,” following the example of the Mona Lisa, its value will generally increase.

The role of an investor is to buy assets that have potential for future value growth at a relatively low current price. If an investor judges that the NFT music notes have the potential to appreciate in value, they might make a high-priced purchase.

So, when you see news like “That piece of paper sold at an auction for 10,000$!” it essentially reflects this dynamic.

NFTs are actively traded as investment assets just like stocks, bonds, gold, real estate, oil, natural gas, and more. They are gaining prominence within the ecosystem of capitalist economies, where stronger entities (investors) support “potential beneficiaries,” contributing to their growing presence.

From the world’s largest market cap company, Apple, to renowned Japanese brands like Toyota, to global chains such as McDonald’s and Domino’s Pizza, as well as giants like Amazon and Costco, entertainment destinations like Disneyland and Universal Studios, well-known apparel brands like Nike and UNIQLO, movies and animations, traffic updates, weather forecasts, convenience stores, fast-food restaurants, and even the life-saving vaccines during the pandemic—none of these could exist without the support of investors.

NFTs have integrated themselves into this ecosystem, becoming another avenue through which the capitalist economy functions. Just as investors back these established institutions and products, they also contribute to the potential value growth of NFTs, providing a way for emerging creators and talents to gain recognition and support.

The Digital Network Era

“The Digital Network Era” can also be described as a time when the concept of value and ownership is inevitably progressing in this direction.

Moreover, there are unfortunate aspects of the digital network era where people who don’t understand this concept properly attack the emerging trends online without even showing their faces.

There are those who say, “Trading things without a tangible presence and value? That’s not relevant to my life.” It’s true that how you choose to live is entirely up to you; it’s your life. Others have no right to meddle in your affairs. This is absolutely correct.

In other words, if someone chooses to live a life where they receive their salary in cash envelopes, have no bank accounts, possess no cash cards or credit cards, pay all utility bills in cash by visiting each service provider, avoid online shopping and subscription services altogether, and even throw away points that accumulate from purchases saying “equivalent to cash,” then they are someone who can strictly discipline themselves.

Without us realizing it, NFTs are already beginning to underpin the foundations of our lives. So, if you intend to keep saying, “Trading things without a tangible presence and value? That’s not relevant to my life,” you will have to strive even harder going forward.

NFT excels particularly in providing proof of uniqueness, which means that as its adoption progresses, tampering with official documents, counterfeiting currency, abusing electronic contracts, forging various types of tickets, and hacking electronic keys – all of these become impossible.

From online banking, e-books, news, sports, education, communities, job searching, certification acquisition, transportation, distribution, agriculture, industry, food delivery, online shopping, and countless other aspects of our daily lives, there’s no end to the things that can be related to NFTs.

We are currently living in an era where all these changes are taking place.

Wrap-up

…This has turned into a lengthy blog, but as you can see, it’s a topic that requires breaking down established notions to truly comprehend. I kindly ask for your understanding in this regard.

If you still find it challenging to fully grasp, I encourage you to revisit this blog as many times as needed, updating your understanding to a global standard.

I want to express my heartfelt gratitude to all of you who have stayed with me until the end of this extensive blog.

※On July 26, 2023 (one week after posting this blog), “Traumatized Man,” who is both the creator and the first owner of the “BrokenHeart” digital art (a punkish heart image that has been pasted into this blog), received a direct inquiry: “I want to purchase “BrokenHeart” right now, but I’m encountering an error and can’t complete the process.” Being asked to help, I tried on my own iPhone, thinking I might encounter a similar error, but to my surprise, the purchase went through smoothly (to be precise, I personally purchased it for 0.035 ETH through the Screaming Poet’s Society NFT gallery. The purchase price of 0.035 ETH is approximately 60$ USD). I might have considered buying it and reselling it to them at a slightly higher price, covering the gas fees, but upon reflection, this artwork is essentially Traumatized Man’s debut NFT creation, and it even feels as though it came to me with the intention of the artwork after those incredible two years. Apologizing, I conveyed to Traumatized Man that he should explain the situation to the individual and apologize politely. For now, I’ve decided to personally own the artwork. I also added a request that he consider creating a similar art collection for that individual in the near future. Unless there’s a rush of investors, I intend to hold onto BrokenHeart and keep it as a non-sale item, cherishing it as an exhibition piece. This journey through a series of twists and turns resulted in the ownership of a single piece of digital art. For those interested, I encourage you to visit the gallery to appreciate it. It should provide a small taste of what the world of NFTs is like, having just recently delved into its study. ←Immediately after the transaction is completed, the seller receives an email from the marketplace (Opensea) like this:(This image is what Traumatized Man received after the transaction was completed.) ←Immediately after the transaction is completed, the seller receives an email from the marketplace (Opensea) like this:(This image is what Traumatized Man received after the transaction was completed.)The change that occurred due to this transaction: The NFT digital artwork “BrokenHeart,” created and owned by MoxArt (the “Traumatized Man” from Mexico), was purchased by ScreamingPoets (the NFT account of the Japanese band) at the seller’s desired price of 0.035 ETH (approximately 60$ in current value). As a result of this transaction, the ownership of the artwork transferred from MoxArt to ScreamingPoets, and the entire digital network of internet-connected devices recognized this change. Furthermore, ScreamingPoets chose to retain ownership of the artwork without engaging in resale, maintaining the status of ownership. |

| ※ETH stands for “Ethereum,” which is a cryptocurrency abbreviation. Alongside Bitcoin, it is one of the most widely used cryptocurrencies in the world. Ethereum is the basis for a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications. In the context of NFT transactions, Ethereum serves as the primary currency, and it is commonly referred to as “ETH.” The world’s largest NFT marketplace, “Opensea,” generally uses Ethereum (ETH) as the trading currency. In terms of currency units, “Ether” is the common pronunciation for “ETH.” |

最新の投稿を

プッシュ通知で受け取る

-

前の記事

“演奏人口増”の視点で語るNFT 2023.07.19

-

次の記事

記事がありません